How can one make sense over current economic policy struggles in Washington? Last year, I called attention to the stakes: “What is clear at this point is that the US regime of neoliberalism that has dominated public policy for the past 40 years has been dislodged. What remains less clear is what will replace it.” The social contract—that is, the economic bargain between the US government and its citizens—came into play in 2021 in a manner not seen in decades. I added that “establishing a new social contract could never be expected to be easy”—and indeed it has not been so far.

The stakes remain just as high today, even if it is easy to lose sight of that fact amid the media chatter about the latest poll numbers about the upcoming midterm elections or the musings of Senator Joe Manchin (D-WV) and Senator Kyrsten Sinema (D-AZ). Of course, most of President Joe Biden $4-trillion agenda from last spring has been stymied. What has passed so far is a modest $1.2 trillion infrastructure bill. And even $1.2 trillion is deceptive, since only $579 billion of the bill involves new spending. In terms of new money, what has been committed over the next eight years amounts to less than $220 per US resident per year.

The bottom line is that at present those seeking fundamental change are not winning, at least not in Washington. This is not, however, the end of the story. The struggle over the social contract continues—and may well intensify in the coming years.

Why? For one, the global neoliberal order is seriously fraying. One sign of this is the decline of “just-in-time” production, a central organizing principle of much of the global economic system. If there is a new phrase entering the popular economics lexicon of late, surely it is “supply chain.” For example, this month American Prospect is running an entire issue on “how we broke the supply chain,” a topic that once garnered remarkably little attention except by specialists.

Simply put, present-day supply chain issues point to an economy in flux. And I haven’t even touched on broader issues—such as the ongoing pandemic and the climate emergency. The high degree of economic instability means there is greater division among elites and more opportunity for social movements to break through and advance transformative change, even if that is not what is visible right now.

But how might that happen? Considerable energy is often placed on having the right messaging and narrative strategy. That’s important. But it’s also important to have a clear-eyed view of the political terrain. It is not uncommon to acknowledge that the US is largely ruled by a wealthy elite—“plutocrats are going to plute,” as philanthropic critic Anand Giradharadas put it at a Harvard conference back in 2019. But to change the system requires taking present-day plutocratic dominance of the US political system seriously—and developing strategies to upend it.

The US Political System Today: Who Are the Dominant Investor Blocs?

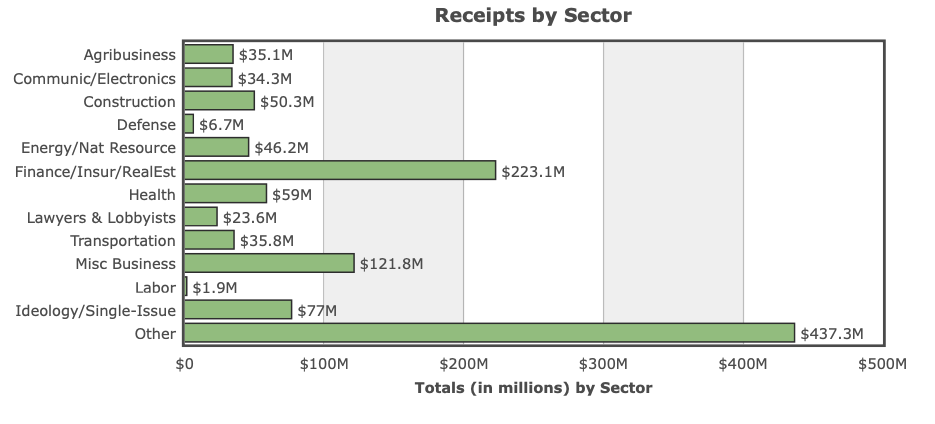

Take a close look at these two charts below, both which are made available by Open Secrets—a nonprofit, nonpartisan watchdog group. The graphs represent the campaign donations that were received by the Democratic and Republican parties in the 2020 US election cycle. Both parties raised roughly similar amounts of around $1.5 billion. Can you tell which graph represents which party?

While there are some clues that should enable you to figure out which graph represents which party, it might not be immediately obvious. The so-called FIRE sector (finance, insurance, and real estate) gave $223.1 million to one party and $192.4 million to the other, roughly a 54-46 percent split. The healthcare industry likewise split nearly down the middle with $59 million going to one party and $65 million to the other.

If you look at the charts closely, some industry splits are clear. Agribusiness, construction, energy, and transportation gave four times more to one party than the other—yes, that top chart is the GOP. By contrast, communications-electronics—that’s your tech industry—favored Democrats nearly three-to-one. Lawyers favored Democrats by more than two-to-one. If you look closely, you might also notice that labor gave seven times more to Democrats than Republicans, although roughly 99 percent of Democratic Party donations came from sources other than labor.

There are a couple of other key differences to note. Miscellaneous business interests favored Republicans by roughly a 3-2 margin, while “single issue” donors favored Democrats by roughly a 3-2 margin. “Main Street” businesses, in short, lean Republican, but not as heavily as the US Chamber of Commerce would lead you to believe. Single-issue donors is a broad category—everything from pro-gun groups to gun control groups to groups like Emily’s List that back women candidates; it’s not surprising that more of these donors favor Democrats than Republicans.

Now, there is a lot these figures do not include. They do not include contributions to individual candidates, nor third-party expenditures (political action committees and the like), nor independent grassroots mobilizing efforts, nor lobbying between elections. Nonetheless, while the picture offered is highly imperfect, it is illuminating. On one side, you have resource-extractive industries and on the other lawyers and tech industries, with finance and pharma supporting both parties fairly evenly.

Where is the party of the people? That doesn’t seem to exist at all. This point is often elided. At a conference last year, Giridharadas contended that, “The right has to overperform the number of people who will benefit from its policies by 40–50 [percentage points of the population].… The level of athletic training is extraordinary. It is dead in the water unless it is out-of-this-world talented.”

But look at those two charts above again. Are lawyers and tech leaders (core Democratic Party investor groups) more aligned with “the people” than core Republican investor groups?

Maybe to some extent? But it isn’t obvious. A core messaging challenge for progressives within the Democratic Party is avoiding incoherence, as messaging must contend with Democratic Party politicians who straddle corporate and movement-based constituents. Pulling that off requires incredible training.

Of course, there is another option, which is to form a separate political party. But in the US electoral system, that is even more difficult. Forming a “third party” may make messaging easier but is an extraordinarily hard civic infrastructure building challenge.

Regardless of the tactic—working within the Democratic Party apparatus to increase movement power or creating an electoral party outside of it—the task is clear. And that task is the ongoing work of building movement infrastructure.

Many years ago, political scientist Thomas Ferguson—in a book titled The Golden Rule: The Investment Theory of Party Competition and the Logic of Money-Driven Political Systems—offered a useful framework for thinking about this. Ferguson argued that we should think of political parties” as “blocs of major investors who coalesce to advance candidates representing their interests” (p. 27, emphasis in original).

The point, Ferguson emphasizes, is not that voting or small “d” democratic politics does not matter—but that unless large groups of voters can become “major investors” in their own right, then elections are likely to “reflect the interests of large investors.” In these contests, “minor investor-voters are virtually incapable of affecting” the outcome (p. 28), except for their power to express no confidence. This is done often; the party out of the White House routinely prevails in midterm elections, for instance. As one analyst observed, “It doesn’t seem to matter who the bums are—or who their replacements will be—as long as we throw them out.” Yet this regular turnover only reinforces major investor control.

Investor blocs themselves, however, are not stable, because the economy changes regularly, propping up some sectors and weakening others. For example, back in 1980, fossil fuel companies comprised 29 percent of stock market value; by 2020, that figure had fallen to 2.7 percent. Climate justice advocates have taken advantage of this declining industry power and have sought to accelerate its decline by getting investors with over $40 trillion in assets worldwide to divest from fossil fuel stocks.

As Ferguson wrote decades ago: “New fortunes, firms, and industries rise, older ones may decline, and any number of related changes begin to occur” (p. 46). Investor blocs in politics tend to be stable—until they are not.

Can voters organize into large enough blocs to become major investors? In Ferguson’s view, they can. In fact, Ferguson argues this once happened before during the period of New Deal liberalism, when, for a few decades—roughly the 1930s through the 1970s—labor unions gained enough clout to become “major investors” within the Democratic Party. Of course, the network of people organized itself is critical, not just money. One shouldn’t read “investor bloc” too narrowly. But sustaining movements requires resources.

Without such an organized voter bloc, Ferguson notes, policy competition tends to oscillate between two parties representing different elite factions, with “the bums” regularly thrown out by voters, even as economic justice gets short shrift regardless of which party is in control—a pattern that is not unlike the one we are seeing today.

Investment Blocs Today—Is an Opening Emerging?

One claim of the investment theory of politics is that in an elite-dominated political system where investor groups across industries share common interests, public policy breakthroughs on issues are rare. One prominent issue of this kind is tax policy.

Indeed, if one looks at tax policy during the neoliberal era, a remarkable shift has occurred. Back in the 1960s, when labor unions retained significant political power, the wealthiest 400 families paid taxes at more than twice the rate paid by the poorest 50 percent of Americans. By 2018, however, the poorest 50 percent of Americans faced an effective tax rate of 24.2 percent, higher than the 23.0 percent paid by the country’s wealthiest 400 families. Biden’s Build Back Better bill was supposed to even the scales somewhat and raise taxes on the wealthy, but these efforts have been stymied, at least so far. This is true even though polls show most US voters—both Republicans and Democrats—have long favored raising taxes on both the wealthy and corporations.

This logic doesn’t just play out with tax policy. This past January in California, proponents of single payer health insurance failed to get a majority even though three quarters of Assembly representatives were Democrats. Writing in the New Republic, Abdul El-Sayed notes that the measure failed because it “was a nonstarter for California’s most powerful business groups…including the California Association of Health Plans, the California Hospital Association, the California Medical Association, and the California Agents and Health Insurance Professionals. And these are the groups from whom too many Democrats take donations…and political orders.”

On a brighter note, the fact that these measures are being publicly debated today is a sign of movement. The 2020 presidential campaign of Senator Bernie Sanders (I-VT)—who famously called for higher taxation on the wealthy and single-payer insurance—raised over $114 million in small donations ($200 or less). In short, this mass network served to make Sanders a powerful player in Washington, even though he failed to secure the Democratic nomination. Ferguson’s framework helps explain how the progressive bloc has gained power within the Democratic Party in recent years.

Ferguson, however, argues that developing a sustainable bloc of working-class voters beyond a single election requires building civic infrastructure, marked by “a resilient network of ‘secondary’ organizations capable of spreading costs and concentrating small contributions from several individuals to act politically” (p. 29). Historically, unions played this role. In the future, it is possible other intermediary structures such as social movement networks or cooperatives might be able to play similar roles.

Beyond Elections

Electoral politics are certainly important, but social change typically begins and builds strength elsewhere. More often than not, elections ratify past movement gains. Leading movements of the 20th century and the early 21st century—such as the African American Civil Rights Movement, the movement for LGBTQ rights, and feminism—built their networks outside of electoral politics and only later had gains codified in legislation.

As Nicholas Harvey has pointed out in NPQ, social movements have a unique ability to disrupt the status quo and, at least for a time, create space for major change that—if advocates are successful—might be consolidated in a new policy equilibrium. The Black Lives Matter demonstrations of 2020, which mobilized as many as 26 million people, illustrate the power of movement to shift the realm of the possible.

Of course, most movement activity—like electoral infrastructure—occurs outside of public view. The marches of 2020, for example, wouldn’t have happened without the many years of organizing that preceded them.

Breaking the stranglehold of plutocratic domination will not be easy. But a new social contract—one that promotes universal thriving rooted in a multiracial democracy—is still a viable goal. Getting there requires what it has always required: that movements deepen and refine their visions of liberation and a solidarity economy, and build the political power needed to achieve that vision over time.

0 Commentaires